October 21, 2025

The government shutdown has now run for three straight weeks. The shutdown has caused a host of disruptions across America – from shortages of personnel at certain airports causing flight delays to the expiration of Federal Flood Insurance needed to close mortgages for real estate transactions. Of course, no sector is suffering more than the government workers who are furloughed and thus not getting paid. That is precisely the most severe pain point inflicted by this horrendous mess.

Regarding the economic sector, it is increasingly hard to measure the effect of the shutdown upon the economy. We can surmise with relative certainty that the shutdown is causing a negative effect. But it is hard to determine how severe this effect is. Why? Because the government has stopped issuing reports of most economic data. For example, we can be relatively certain that hiring is affected negatively, especially since the government has also begun laying off thousands of government workers. But we don’t know how badly the labor market is being hit because the government is not issuing employment reports. We can project from alternative data sources, such as the ADP payroll report, but these reports don’t always align with government data.

Apparently, the Department of Commerce is going to issue a belated inflation report next week. That is timely, especially because the Federal Reserve’s Open Market Committee is scheduled to meet next week as well. The Fed will be making a decision on interest rates amidst this dearth of data. We have mentioned previously that the Fed’s balancing act between fighting inflation and a slowing economy was difficult. Now it is more herculean to say the least. Certainly, the Fed can see that the trajectory of slower hiring of the past few months is likely to be exacerbated by the shutdown. If this is the case, then another rate cut is more likely. We will see…

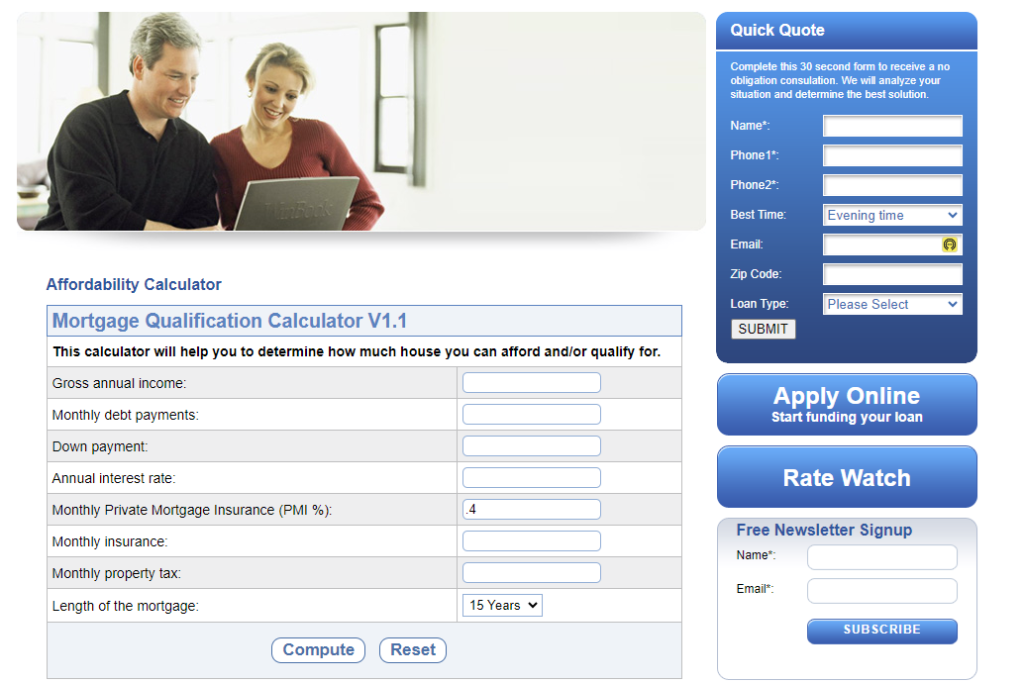

Source: Origination pro

AMERIMUTUAL is an Upfront Mortgage Broker that places a premium on transactional transparency. Our valued clients appreciate this advantageous approach and enjoy the benefits of having a mortgage broker that is fully aligned with consumer interests.

Contact Us

Philip Loria, President

Benny Loria, Vice President

| Phone | (718) 943-9200 |

| info@amerimutualmortgage.com | |

| Fax | (718) 204-0657 |

| Address | 18-33 41ST Street, 2nd Floor Astoria, NY 11105 |