October 27, 2025

The Federal Reserve’s Open Market Committee meets today and tomorrow, and a major topic of discussion will be the economy and whether to lower interest rates. As we discussed this week, the Fed is meeting with a substantial lack of data due to the government shutdown. There are a few reports still being issued, typically by private sources. These include existing home sales, builder confidence and the ADP private payroll report. But significant data such as the jobs report, retail sales, personal income/spending and more are on hold because of the shutdown.

The government did release the delayed consumer price index on Friday, an exception because this data determines the 2026 cost of living increase for social security. The CPI came in up 0.3% from September and 3.0% higher on an annual basis. Excluding food and energy, the core CPI came in at 0.2% monthly and 3.0% annually. These figures were less than expected but continue to be higher than the Fed’s target of 2.0% annual inflation. This report is certainly one watched closely by the Fed. This question must follow – how does the Fed make a decision without much of the data which is so important?

Members of the Fed certainly have not been quiet during the shutdown. As usual, the members opinions are all over the board. Of vital importance is the fact that Fed Chair Jerome Powell recently suggested the central bank is nearing a point where it will stop reducing the size of its bond holdings and provided a few hints that more interest rate cuts are in the cards. Speaking to the National Association for Business Economics conference in Philadelphia, Powell delivered a dissertation on where the Fed stands with “quantitative tightening,” or the effort to reduce the more than $6 trillion of securities it holds on its balance sheet. Though there was no timetable suggested, the fact that the Fed is now considering this change in policy bodes well for those who are hoping for a decrease in rates this week, and if the Fed starts purchasing bonds and perhaps mortgages to replace the portfolio runoff, this could also bode well for the direction of mortgage rates.

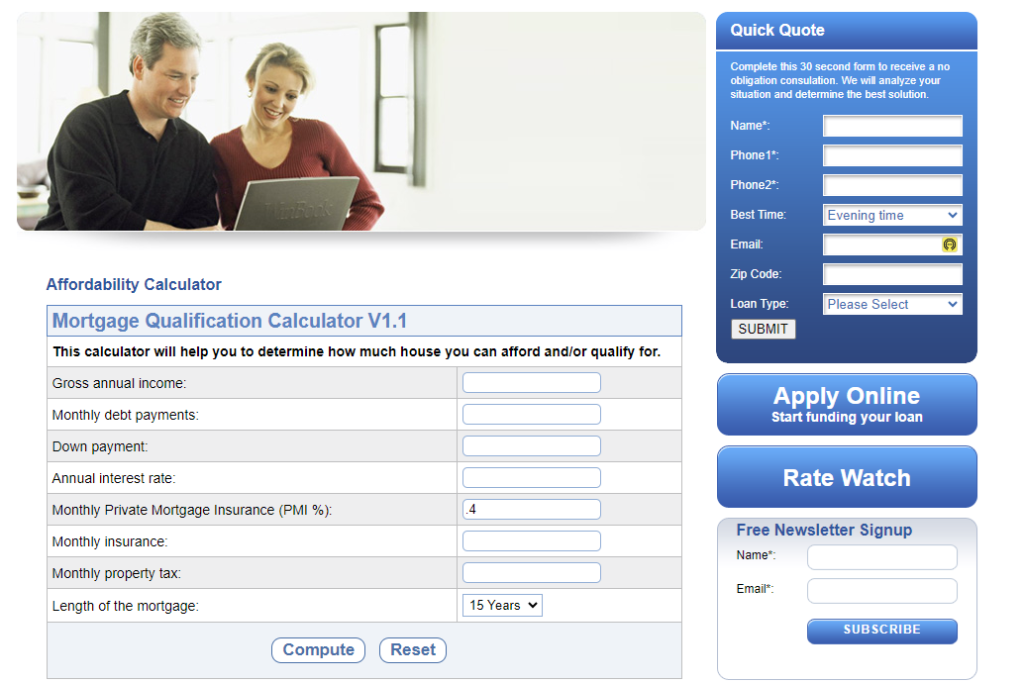

Source: Origination Pro

AMERIMUTUAL MORTGAGE located in Astoria NY is an Upfront Mortgage Broker that places a premium on transactional transparency. Our valued clients appreciate this advantageous approach and enjoy the benefits of having a mortgage broker that is fully aligned with consumer interests.

Contact Us

Philip Loria, President

Benny Loria, Vice President

| Phone | (718) 943-9200 |

| info@amerimutualmortgage.com | |

| Fax | (718) 204-0657 |

| Address | 18-33 41ST Street, 2nd Floor Astoria, NY 11105 |